All my time during trading and enhancing my skills i read primarily two type of stuffs , one which provide and enhance my charting skills ( Tech knowledge ) and two about human behavior in general

Technical knowledge is fairly easy to understand and master . All you need is a good mentor and mastery in technical concepts

Here are few things that you need to understand to read charts like a pro

- Good understanding of Candlesticks

- A strong grip on market economics and major economic concepts Like inflation and Interest rates

- Ability to read naked charts – Price action alone

- Ability to understand market structures – Price patterns . Consolidation , Continuation and reversal patterns

- A good risk to reward structure while taking trades

- A good risk management system

To master these things and creating your own strategy after back testing , You might take several months . But once you have achieved it you are now at stage where you can call yourself a TRADER !!

Read a bit more about creating your own trading system Here

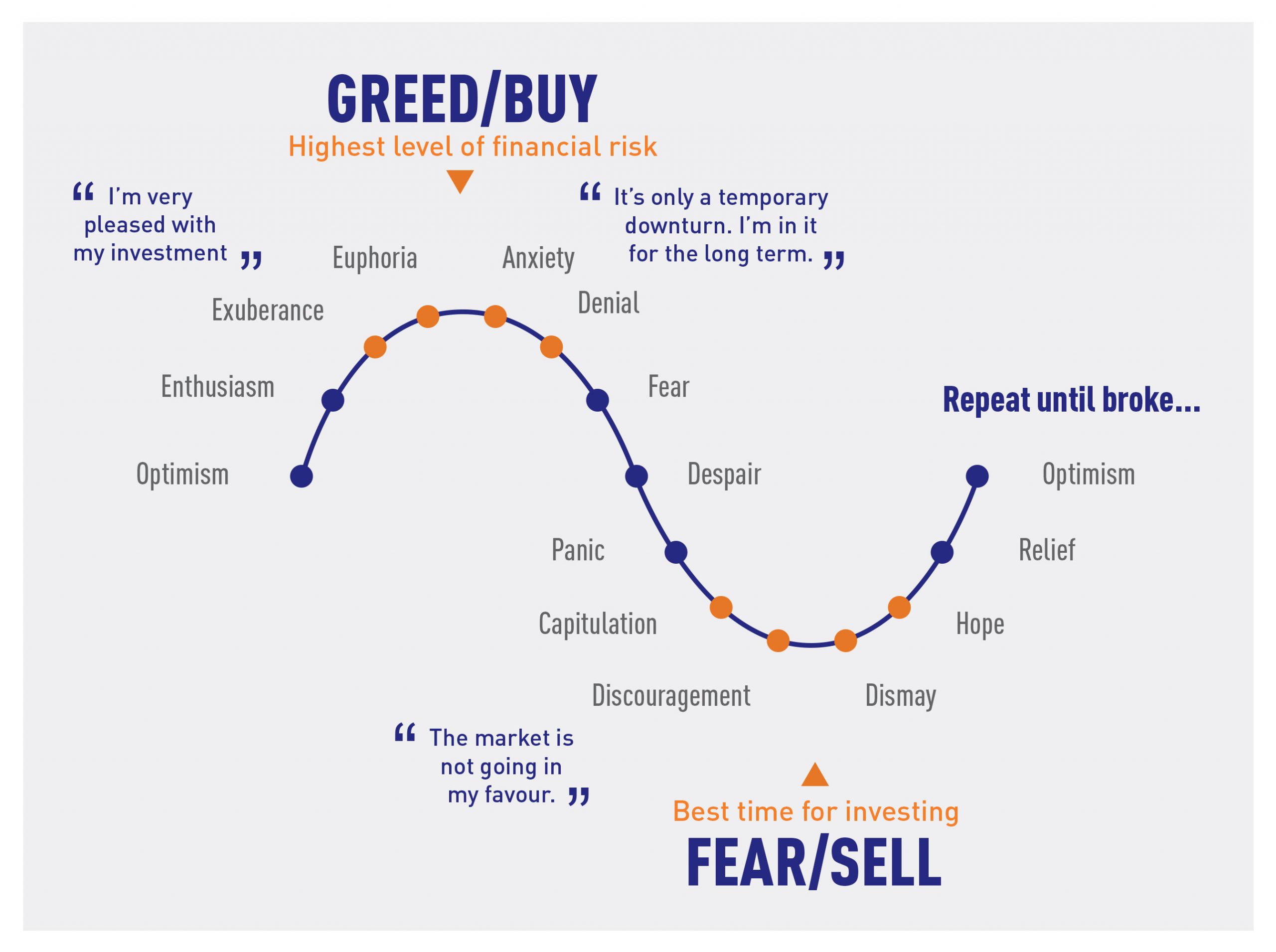

I have seen people achieving this fate very quickly but still lack something to call themselves as a consistent and profitable trader

Trading psychology

Some of you might have experienced this

- Amateur trader opened his first trade and closed in profits . Trading with confidence opened another trade and again closed in profits . At this points he beliefs that he is a champ and he can make consistent money in this business

- Intermediate trader opened his first trade and closed in loss . He started to have doubts in his trading system , he opened another trade and closed trade in loss again . At this point he lacks confidence and he starts to believe it hard or impossible to make money in this business

The only difference is Positive attitude , unfortunately it only comes when u win a trade and u have develop it even if you are loosing a trade. There could be two possible future scenarios in the above mentioned cases

Two scenarios of Amateur trader

- He will continue to win ( Very unlikely possible with limited technical knowledge )

- He will get greedy ( very likely to happen ) and take more risk and eventually looses his capital and profits

Two scenarios of Intermediate Trader

- He will eventually stop trading and think there are faults in his trading system or he will try to lean new skills or some new indicator ( very likely to happen )

- He will Continue trading and develop positive attitude and trust on his strong system which he has built it with lot of back testing , he will ultimately get profitable ( very unlikely to happen )

A very good trading system will fail , if you cannot control emotions and do not understand trading psychology . Each professional trader i have met will only talk about controlling emotions and use those methods in their trading system to achieve which only few can achieve

After creating your trading system if your still have doubt on your skills i would definitely recommend you to read this book

Trading_in_the_Zone_Mark_Douglas

Markets will continue to show volatile behavior . Traders can still take benefit by only understanding market structure and controlling risk

Take care all Stay Fit

#letsfight #covid19 #together